In California, the rules surrounding security deposits for rental properties have long been a point of contention between landlords and tenants. Assembly Bill 2801 (AB 2801) was introduced to bring clarity and fairness to the process of security deposit deductions. For both tenants and landlords, understanding the implications of this bill is crucial for navigating the rental landscape in the state. In this article, we’ll explore the changes introduced by AB 2801, how it affects security deposit management, and what it means for the real estate market, especially for landlords managing multiple properties.

Understanding Assembly Bill 2801

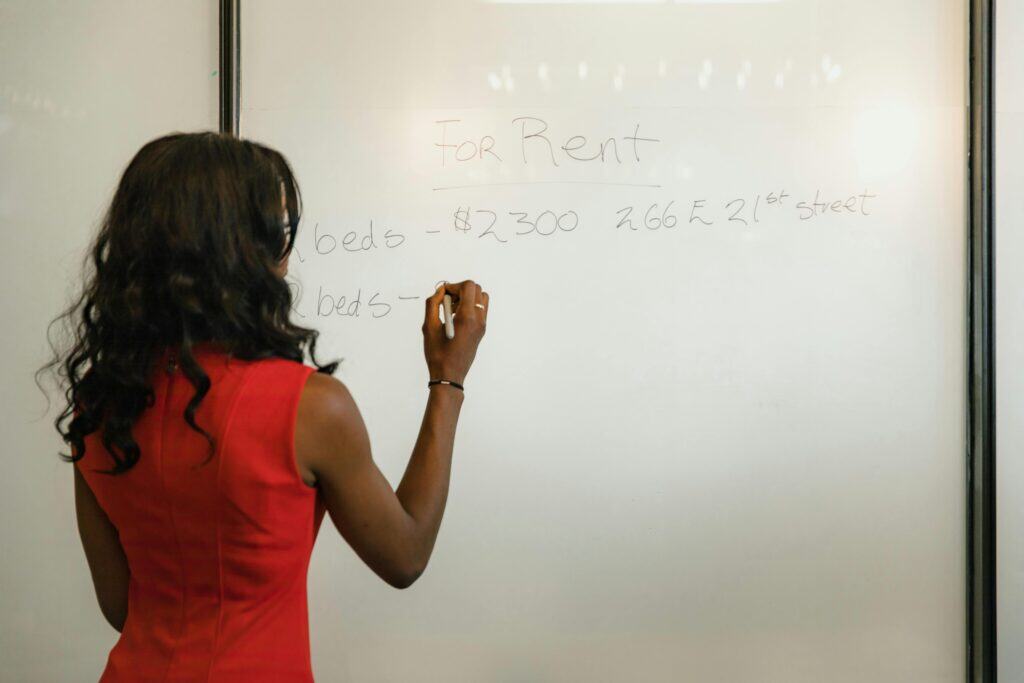

Assembly Bill 2801 was introduced to address a common source of disputes between landlords and tenants—security deposit deductions and will take effect July 1st, 2025. The bill requires landlords to provide photo documentation when making deductions from a tenant’s security deposit, ensuring greater transparency in the process. This is a significant change, as it mandates that landlords must not only itemize deductions but also prove that the damage or need for repair exists through photographic evidence.

Prior to AB 2801, tenants often contested deductions for normal wear and tear, or landlords might charge for repairs that the tenant believed were unwarranted. With photo documentation now required, tenants have more leverage to dispute any unwarranted deductions, and landlords must be diligent in documenting legitimate damage to protect their claims.

Key Provisions of AB 2801

Photo Documentation Requirement

Under AB 2801, landlords must provide photo evidence when withholding part of a tenant’s security deposit for repairs or cleaning. This evidence must be detailed and show the exact areas or items that require repair or cleaning beyond normal wear and tear. Along with the photographic evidence, the landlord must also provide an itemized statement listing the costs of these repairs or cleaning services.

This requirement aims to create more transparency in the security deposit process, reducing conflicts between tenants and landlords regarding the legitimacy of security deposit deductions. It also ensures that tenants are only charged for damage or cleaning that is beyond what is considered normal for a rental property.

Expanded Timeline for Disputes

AB 2801 also impacts the timeline for disputes over security deposit deductions. Once a tenant moves out, the landlord must provide an itemized statement of deductions and the accompanying photo evidence within 21 days, as required by California law. However, if the tenant disputes the deductions, they now have more tools at their disposal to challenge unfair claims. Tenants can now refer directly to photographic evidence and question any deductions that don’t align with the evidence provided.

For landlords, this means it’s critical to be thorough when taking photographs of the rental property after a tenant moves out. Landlords must ensure that all damages are properly documented to support any claims they make against the security deposit.

What Does AB 2801 Mean for Landlords?

Stricter Documentation Requirements

For landlords, AB 2801 adds a new layer of responsibility when managing rental properties. The requirement to provide photo documentation means that landlords must have a more structured process for inspecting properties when tenants move out. Landlords should invest in high-quality cameras or smartphones to ensure that the photos are clear, timestamped, and accurately depict any damage that requires repair.

Landlords must also ensure that the photos align with the itemized statement they provide to the tenant. Any discrepancies between the photos and the deductions may lead to disputes, so it’s essential that landlords are meticulous in both documenting and communicating the reasons for withholding part of the security deposit.

Reduced Risk of Disputes

On the positive side, the photo documentation requirement reduces the likelihood of disputes between landlords and tenants. By providing clear evidence of damage, landlords can justify their deductions and prevent conflicts that may arise from unclear or subjective claims. In turn, this can reduce the number of legal challenges landlords face regarding security deposit deductions, creating a smoother process for both parties.

Adapting to New Compliance Standards

Landlords, especially those managing multiple properties, will need to adjust their practices to comply with AB 2801. It’s important to implement standardized procedures for move-out inspections, ensuring that all necessary photos are taken and securely stored. Property management software can be a useful tool for keeping track of these inspections and maintaining records of photos and itemized statements.

Additionally, landlords may want to update their lease agreements to reflect the changes brought about by AB 2801. By including clauses that inform tenants of the new photo documentation requirements, landlords can ensure transparency and avoid confusion when the time comes to return the security deposit.

How Does AB 2801 Affect Tenants?

Increased Transparency and Protection

For tenants, AB 2801 offers greater transparency in the rental process. Tenants are now entitled to see photographic evidence of any damage or need for cleaning that leads to security deposit deductions. This levels the playing field for tenants, allowing them to understand exactly why deductions are being made and providing them with the opportunity to challenge any unfair claims.

This also means that tenants should be more mindful of documenting the condition of the property when they first move in and when they move out. Having their own photos can help them dispute any claims that they believe are unfair, especially if they believe the damage or cleaning issues were pre-existing.

Fairer Security Deposit Deductions

Under AB 2801, tenants are protected from landlords making arbitrary or unjustified deductions from their security deposits. With the requirement for photo documentation, tenants can rest assured that they will only be charged for legitimate damage or cleaning beyond normal wear and tear. This creates a fairer rental environment, where tenants know their security deposit is protected unless there is clear evidence of damage.

Additionally, the expanded ability to dispute deductions ensures that tenants can challenge any claims they believe are unjustified, offering them greater peace of mind during the move-out process.

Implications for Property Management Companies

Streamlining Compliance

For property management companies, AB 2801 introduces new compliance challenges. Managers must ensure that all properties under their care follow the new requirements for security deposit deductions. This may involve training staff on how to properly document damages, use cameras or mobile devices effectively, and organize photographic evidence for easy access.

Property management companies will also need to ensure that they are up-to-date on all local and state regulations to avoid any legal issues. By adopting standardized procedures across all properties, companies can remain compliant while reducing the risk of disputes with tenants.

Enhancing Tenant Relations

By embracing the transparency brought about by AB 2801, property management companies can improve their relationships with tenants. Tenants are likely to feel more confident renting from a company that adheres to fair and transparent practices. Property management companies can highlight their compliance with AB 2801 as a selling point, attracting more tenants who value fair rental practices.

Partner With AllView Real Estate

Navigating the complexities of new legislation like AB 2801 can be challenging for both landlords and tenants. AllView Real Estate is here to help property owners and tenants understand these changes and ensure compliance. Our expert property management services in Los Angeles County, Orange County, and San Diego County provide comprehensive support, ensuring that landlords remain compliant with new regulations while maximizing their property investments. Reach out to AllView Real Estate today to learn more about how we can assist with managing your properties and navigating the evolving rental landscape.

Disclaimer: AllView Real Estate does not provide legal advice. This material has been prepared for informational purposes only. All users are advised to check all applicable local, state, and federal laws, and consult legal counsel should questions arise.